Bank of Canada hikes interest rate to 2.5% -biggest jump since 1998 Social Sharing

Canada’s central bank raised its benchmark interest rate by a full percentage point to 2.5 per cent. That’s the biggest one-time increase in the bank’s rate since 1998.

Report says tax on $1M+ homes could be key to making housing more affordable

An annual surtax on houses valued over $1 million could help reduce housing inequality and cool housing markets, a report says.

Toronto home sales lead to record 2021 despite weaker December

A resurgence in demand for Toronto homes contributed to record residential real estate sales and prices in 2021 despite a dip in December.

A Toronto mall around for over five decades will be completely demolished

Toronto’s brick-and-mortar retail landscape has suffered immensely with the rise of online shopping and exponentially more during the pandemic, and it looks like the thirst for new housing could soon bring about the end of a shopping mall that’s been a North York staple for over a half-century.

Ontario condo developer suddenly cancels years-long sales deal – unless buyers pay $100K more

The foundation has been poured for Soraya Palma’s first home and she’s paid most of the deposit. But the 29-year-old says she now has no choice but to walk away from the Barrie, Ont., development.

August home sales down, prices up as supply fell 43%

August home sales slowed from the frenzied pace seen earlier in the year, but market conditions have tightened as supply plummeted by 43 per cent and prices rose yet again

Liberals promise helping hand to first-time homebuyers through loans, grants

Liberal Leader Justin Trudeau says a re-elected Liberal government would help renters become homeowners through $1 billion in loans and grants.

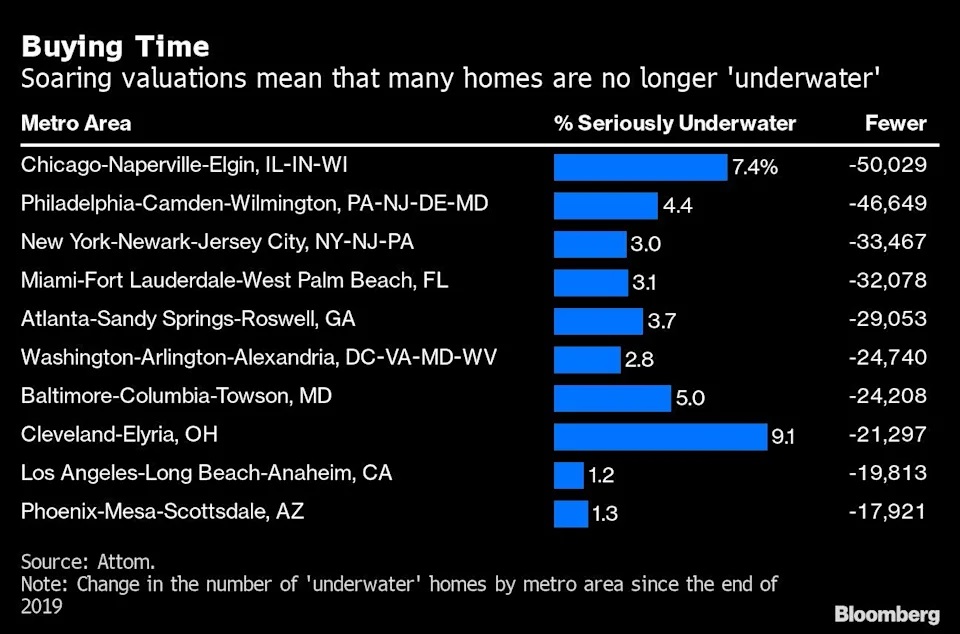

U.S. Housing Boom Rescues More Than 1 Million ‘Underwater’ Homes

The pandemic housing boom has pulled more than 1 million U.S. homeowners out of a debt trap that many had been stuck in since the great financial crisis more than a decade earlier.

Canada housing market: GTA home sales fall in July but prices remain high

Fewer homes traded hands in the Greater Toronto Area (GTA) in July. But demand remains strong and prices remain out of reach for many first-time buyers.

Residential investment overtakes business in share of Canadian economy: CIBC

Canada’s real estate market is such a key economic driver that residential investment recently surpassed business investment in percentage share of the economy.